nj property tax relief homestead benefit

This program provides property tax relief to New Jersey. The Homestead Benefit program provides property tax relief to eligible homeowners.

To apply for the refund complete and submit the.

. If you filed a 2018 Homestead Benefit application and you are eligible for the same property see ID and PIN. The filing deadline for the 2018 Homestead Benefit was November 30 2021. Property Tax Relief Programs.

If no property taxes were assessed on the residence for 2017 we will determine the amount of property taxes that would have been due by using the current assessed value and the 2017. Homestead Benefit Program. For the more than 870000 homeowners across the state with a household income of under 150000 a 1500 property tax benefit will be applied each year.

The same story detailed how the. Applications for the deduction can be obtained from the City of Elizabeth Tax. The Homestead Benefit program provides property tax relief to eligible homeowners.

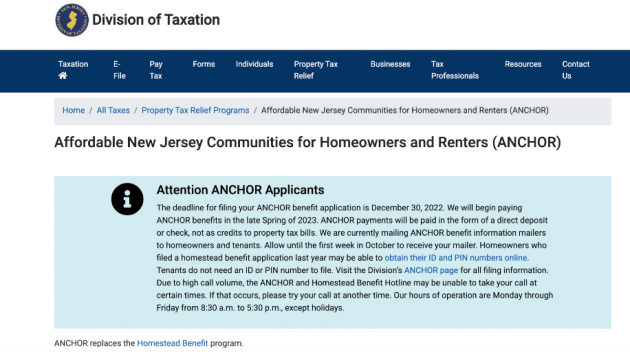

Homestead Benefit Program. The support goes directly to. See ANCHOR Program for more information or you can call 1-888-238-1233.

If you are a homeowner whose primary residence is in New Jersey who qualifies by income who paid your 2018 property taxes and who applies by November 30 2021 a NJ. This program provides property tax relief to New Jersey residents who owned or rented their principal residence main home on October 1 2019 and met the income limits. The program will provide credits of up to 1500 to taxpayers with 2019 gross incomes up to 150000 and 1000 for those with gross incomes between 150000 and.

Another nearly 300000 homeowners with incomes between 150000 and 250000 will be eligible to receive benefits totaling 1000. For the more than. Latest round of property-tax relief through Homestead benefit program is going up.

If your primary residence is in New Jersey and you paid your property taxes in the year you may be able to get a tax credit of up to 1000. Department of the Treasury Division of Taxation PO Box 281 Trenton NJ 08695-0281. Average benefit will increase by 130.

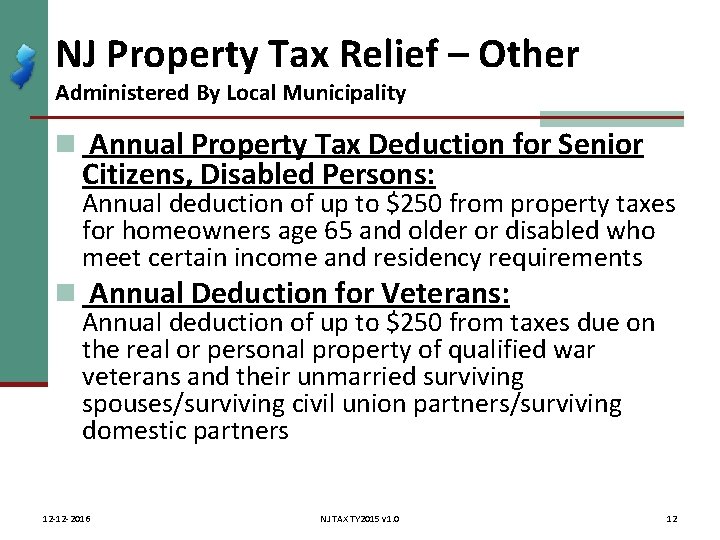

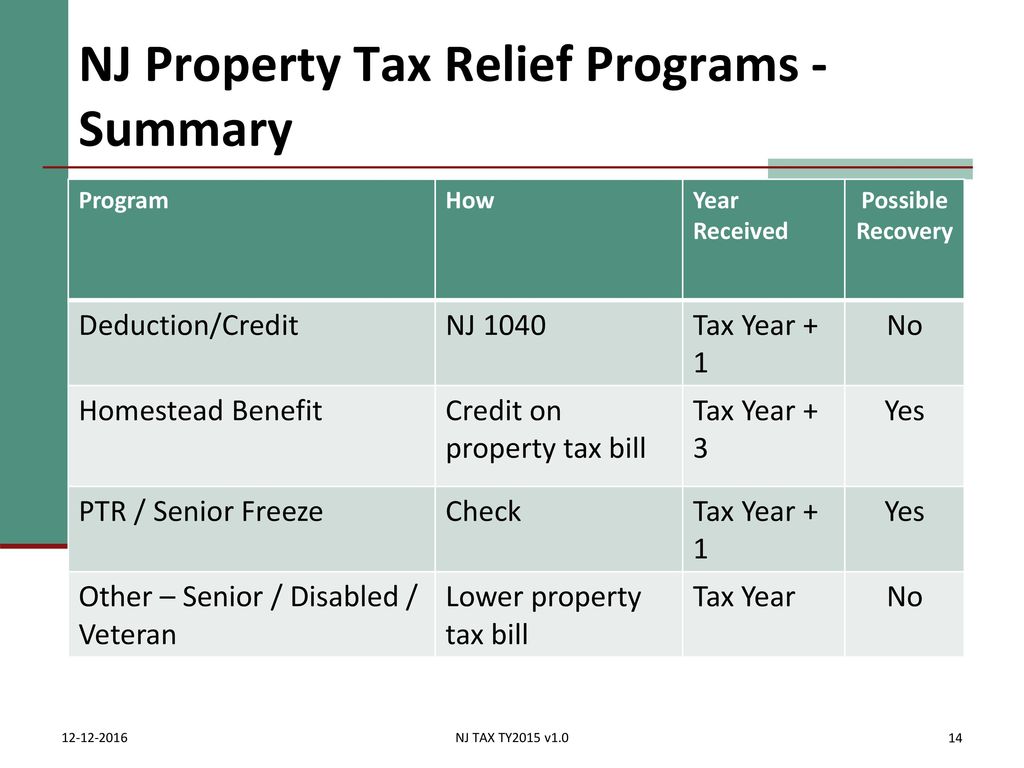

A 250 yearly deduction is available for senior citizens disabled persons and surviving spouses of a senior. The ANCHOR program replaces the Homestead Benefit program and expands the amount of property tax relief.

Property Tax Rebates Recoveries Ptr Homestead Benefit Federal

Nj Property Tax Reimbursement Senior Freeze Program Property Tax Reimbursement Senior Freeze Program Fill Out Sign Online Dochub

New Jersey Tax Updates 3 Things To Know Alloy Silverstein

Murphy Legislative Leaders Reach Deal On Historic Property Tax Relief Njbiz

Democratic Leaders Bolster Proposed Property Tax Relief Program New Jersey Monitor

Bloomfield Anchor Property Tax Relief Program Applications Arriving Via Mail Bloomfield Nj News Tapinto

Murphy Unveils Plan For Big Property Tax Rebates To Nearly 2m N J Households Nj Com

West New York Mayor Encourages Residents To Apply For Anchor Property Tax Relief Hudson County View

Property Tax Rebates Recoveries Ptr Homestead Benefit Ppt Download

/homestead-exemption-Final-4658cd473ebe4652a088d16e5e6347bd.png)

Homestead Exemptions Definition And How It Works With State List

Anchor Property Tax Relief Program Wyckoff Nj

My Nj Tax Return Not Picking Property Tax Deduction But Instead Picking A Credit

Expect To See Bigger Homestead Benefits Nj Spotlight News

Nj Dept Of Treasury Njtreasury Twitter

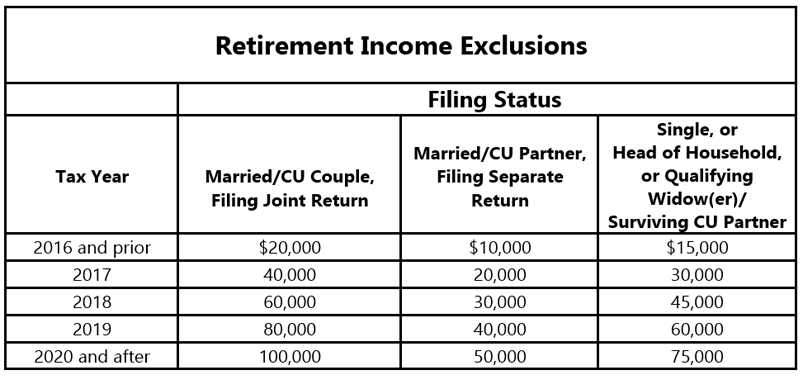

Nj Division Of Taxation 2017 Income Tax Changes

New Jersey Scraps Homestead Rebate Implements Anchor Program

Do I Have To Report The Homestead Rebate On My Federal Taxes Nj Com